BIS Annual Report 2025 - Summary Guide & Commentary

Chapter III Crypto Assets & Stablecoins: An In-depth Summary Guide

Hello and welcome to another edition to the InstitutionalFI

. In this article we are going to give a comprehensive summary to the latest BIS report on digital assets, stablecoins and their potential impact to the current financial infrastructure. So grab a coffee (or a whiskey) as we unpack this report.Who Is the BIS? A Quick Intro

The Bank for International Settlements (BIS) is often called the “central bank for central banks.” Established in 1930, it’s the world’s oldest international financial institution, owned by its member central banks. Its main mission is to foster international monetary and financial cooperation, provide a forum for central bankers to discuss policy, and serve as a bank for central banks—offering services like deposits, asset management, and gold and currency transactions.

Originally, the BIS was set up to handle the collection and distribution of German war reparations after World War I. Over time, as the need for war reparations faded, the BIS shifted its focus to promoting global monetary and financial stability. It played key roles in restoring currency convertibility in Europe after World War II, supporting the Bretton Woods system, and developing global banking regulations through the Basel Accords.

Today, the BIS is headquartered in Basel, Switzerland, and is a hub for research, policy analysis, and international cooperation among central banks.

BIS Annual Report 2025 – Chapter III Summary Guide

Introduction: The Evolution of Money

The BIS start by going into the histroy of monetary systems and the role progressive technology has played in the evolution of monetary policy. The developments of paper ledgers gave birth to digital ones and inturn this brought ‘profound changes to the economy and society.’

It doesnt hide the fact that in recent years, developments with digital ledgers have progessed at rapid rates opening the door to digital innovation. The goal of this chapter is to ‘‘discusses how central banks can light the path to the next generation of the monetary and financial system. This is a system designed to expand the quality, scope and accessibility of financial services by leveraging innovative technologies backed by sound regulation, while preserving the solid foundation of the existing system: central bank reserves as a trusted final settlement asset, supporting private financial sector innovation.’’

Money keeps evolving. From coins to paper, and now to digital, each innovation reshapes finance. Today, tokenisation—recording assets on digital, programmable ledgers—is the next big leap and from here this is where the meat on the bones starts to appear.

Tokenization, What is it? Why does it matter?

Tokenisation is the process of recording claims on real or financial assets that exist on a traditional ledger onto a programmable platform. The BIS go on to acknowledge ‘Tokenisation represents the next logical progression in the evolution of the monetary and financial system, as it enables the integration of messaging, reconciliation and asset transfer into a single, seamless operation.’ Addressing the why it tokenisation matters, tokenisation means turning claims on assets (like money or bonds) into digital tokens on a shared platform. This could make payments, asset transfers, and compliance seamless-faster, cheaper, and less risky.

Futher the BIS said that it would be able to utilize DLT, distrubuted ledger technology to knit together ‘operations encompassing money and other assets that would reside on the same programmable platform. This could be made possible by a new type of financial market infrastructure - a "unified ledger" - which may or may not use distributed ledger technology (DLT).¹ By bringing together tokenised central bank reserves, commercial bank money and financial assets into the same venue, a unified ledger can harness tokenisation's full benefits.’

‘In cross-border payments, tokenisation could replace the complex chain of intermediaries and the sequential updating of accounts in today's correspondent banking transactions with a single, integrated process. Together with state-of-the-art compliance tools made available on the platform, tokenisation would thereby reduce operational risks, delays and costs.’

Now so far, it all seems very postive and it is. Not only have the benefits been highlighted the BIS acknowledges that Tokenisation is the next step that we are heading in, in our monetary system, also they have given us a glimps into the near future of cross-border payments and its structure. No more complex chain of intermediaries, replaced with a single process. Great, but if you thought there wasnt going to be some wholes pocked in it, you would be wrong. Lets get into that, the report quickly jumps into what money is and how stablecoins fail three unique tests. Lets get into that.

The turn of the article starts with highlighting that money needs to remain ‘information-insensitive' meaning that due diligence is not required, implying that there is a layer of trust in the monetary value. This is where the three tests of money comes into play. 1) Singleness. 2) Elasticity. 3) Integrity. These core tests underpin the coordination in the current monetary system, without it, trust would fail and the monetary system would become uunmoored. So inorder to test its ‘Singleness’ test two and three come into play. Elasticity, the system must expand and contract money supply to meet demand inturn avoiding liquidity crunches and finally, Integrity, Money must resist fraud and illicit use adding security and compliance. Here’s the critical insight: These tests are interdependent. Singleness (Test 1) depends on Elasticity and Integrity (Tests 2 & 3). Without elasticity, money shortages breed distrust in its value. Without integrity, fraud erodes universal acceptance. Lose one leg, the stool collapses – and money becomes "unmoored.’’

Tokenising assets on programmable ledgers could revolutionize finance by bundling payments, transfers, and compliance. But the BIS warns: Any new system must pass the three tests to maintain that "information-insensitive" trust. This is where crypto stumbles. Stablecoins trade at variable rates (failing singleness). DeFi lending protocols freeze during volatility (failing elasticity). Pseudonymity enables illicit flows (failing integrity). Central bank money still sets the standard – but tokenisation could help extend that trust digitally.

The Next Generation of Central Banks

If you are still with me, this is where the meat on the bones comes into play. To support the next generation in monetary systems, with central banks being at the core of this transformation. This transformation is ‘the trilogy of tokenised central bank reserves, tokenised commercial bank money and tokenised government bonds, all residing on a unified ledger.’

Tokenised central bank reserves provide a stable and trusted settlement asset for wholesale transactions in a tokenised ecosystem, ensuring the singleness of money. They could also enable monetary policy implementation on a tokenised platform.

Tokenised commercial bank money could build on the proven two-tier system, offering new functionalities while preserving trust and stability

Tokenised government bonds, as the cornerstone of financial markets, could enhance liquidity and support various financial transactions, from collateral management to monetary policy operations.

Stablecoins: Useful Tool, Flawed Foundation

The BIS go one to highlight the flaws that stablecoins in their current state present. While great for fast payments, stablecoins can’t be the monetary bedrock. Why? They lack:

• True elasticity (each new token requires collateral)

• Robust integrity (limited AML controls)

• Universal singleness (trading spreads prove this)

Another risk was mentioned by the BIS, ‘If stablecoins continue to grow, they could pose financial stability risks, including the tail risk of fire sales of safe assets.’

The question is then, can stablecoins evolve to meet the needs of all three tests? Or will they remain a niche bridge between traditional and crypto finance?

“As the stewards of monetary and financial stability, central banks need to drive this transformation. They can do so in four ways. First, they can articulate a vision of which key features of today’s financial system must be replicated in a tokenised ecosystem. Second, they can provide the necessary regulatory and legal frameworks to ensure the safe and sound development and adoption of tokenised finance. Third, they can provide the basic foundational assets and platforms required for a tokenised financial system. Most importantly, such a system will require settlement in a tokenised form of central bank reserves. Finally, they can foster public-private partnerships to encourage joint experimentation and coalesce industry efforts.”

Unsurprisedly the bis continues to essentially tell us that central banks are the ultimate Trust anchors and only central banks can provide unquestioned singleness legal tender status. Elasticity via lender of last Resort power and integrity through regulation and oversight. Now the private sectors innovation paired with Central Bank Trust is the ideal combo however this does link us toward tokenized Central Bank money also known as CBDCs on unified letters this might be the end game merging efficiency with bedrock stability.

The Path Forward

The BIS urges central banks to:

• Build foundational digital infrastructures

• Craft regulations preserving the three tests

• Foster public-private partnerships

Tokenisation isn't about replacing money - it's about upgrading the infrastructure while preserving the “information insensitive” that makes money work the three tests are compass. Forget them, and we risk building a high-tech house on digital sand.

Stablecoins and the integrity imperative: A Reality Check?

Stablecoins and the Integrity Imperative: A Reality Check

The BIS kicks off with a crucial point: for money to function as the backbone of the economy, it must remain “information-insensitive.” In plain English, this means you shouldn’t have to do due diligence every time you accept a payment—there’s a built-in trust that a dollar is a dollar, no matter who hands it to you. This is the glue that holds the monetary system together. But can new forms of digital money like stablecoins deliver this same level of trust?

That’s where the three tests come in:

Singleness: Is every unit of money accepted at face value, everywhere, without question?

Elasticity: Can the system expand or contract the supply of money as needed to keep things running smoothly?

Integrity: Is the system robust against fraud, illicit use, and operational risks?

These aren’t just academic boxes to tick. Fail on any one, and the whole system risks becoming “unmoored”—trust breaks down, and money loses its magic.

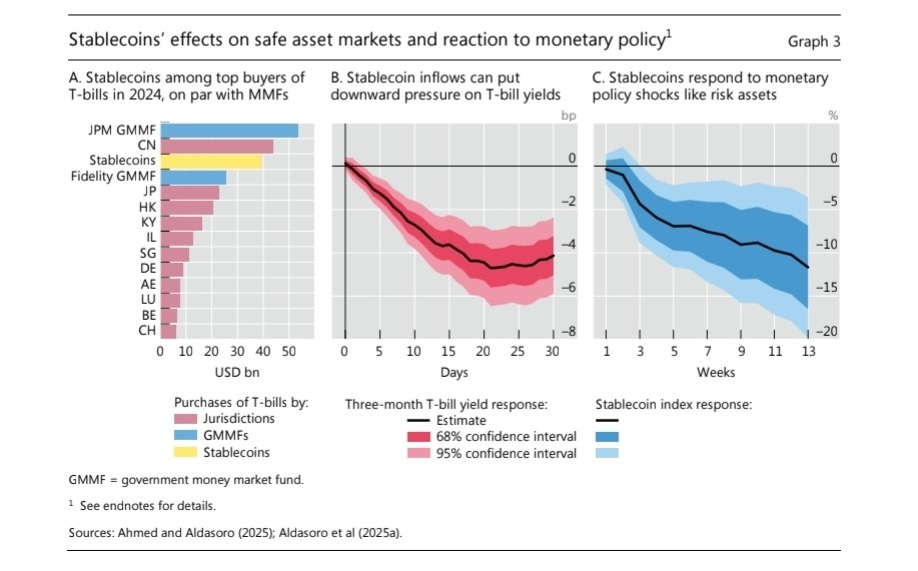

The Singleness Test: Not All Dollars Are Equal

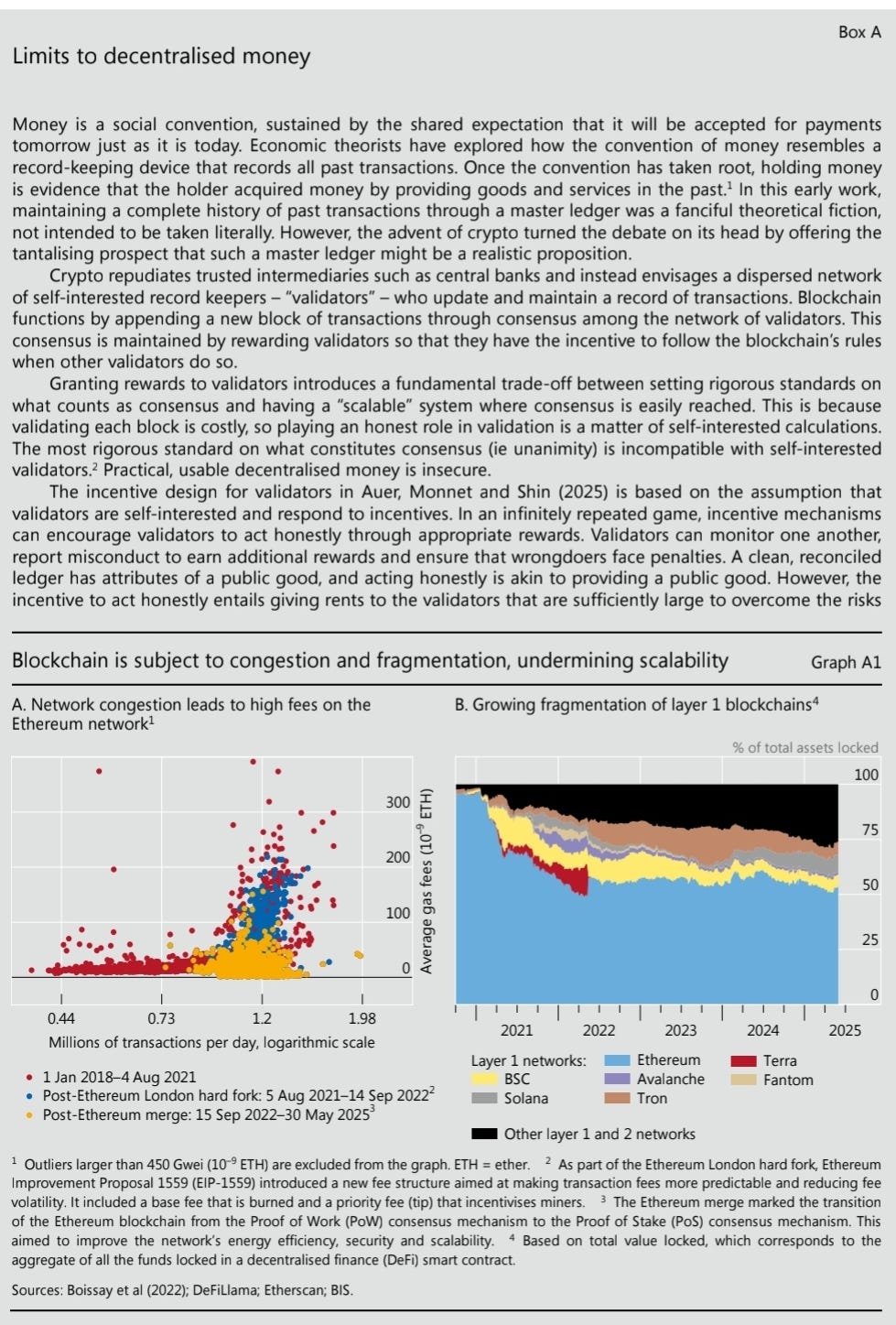

Stablecoins, especially the fiat-backed variety, have exploded in popularity—just look at the hockey-stick growth in market cap, with Tether and USDC dominating the field (Graph 1.A). But here’s the catch: each stablecoin is a liability of a specific issuer, not a universal claim on the financial system. Think of it like holding “red dollars” and “blue dollars”—each tied to a different company, each potentially trading at a different price.

The data backs this up. Graph 1.B shows that even the most “stable” stablecoins exhibit volatility, sometimes deviating from their peg, especially in stressed markets. This undermines the “no-questions-asked” principle. If you have to check which brand of stablecoin you’re being paid in, or worry about its market price, that’s not singleness—it’s fragmentation.

The Elasticity Test: Cash-in-Advance Constraints

Elasticity is about the system’s ability to meet demand for money—especially in times of stress. The BIS points out that stablecoins are fundamentally limited here. Issuers can only create new tokens when fully backed by reserves, which means no capacity to expand supply on demand. This “cash-in-advance” model is worlds apart from the banking system, where central banks can inject liquidity as needed to prevent gridlock or panic.

Large-value payments—think real-time settlements between banks—rely on this flexibility. Without it, the system can seize up. Stablecoins, by design, can’t provide this on-demand liquidity, making them ill-suited as the backbone of a modern monetary system.

Integrity: The Weakest Link

The burden of policing illicit flows currently falls on authorities, not on stablecoin issuers. While issuers and exchanges can freeze balances and work with blockchain analytics firms to trace high-profile crimes (think ransomware), this approach simply doesn’t scale for the billions of everyday transactions that stablecoins now enable. The pseudonymous, bearer-like nature of stablecoins—especially when accessed via unhosted wallets—makes them inherently attractive for criminal and terrorist organizations.

Contrast with traditional finance: In bank-based or e-money systems, customer-facing intermediaries are responsible for KYC/AML checks. They know their customers, face penalties for lapses, and must verify identities before crediting payments. This two-tier, account-based approach is much more robust for maintaining systemic integrity.

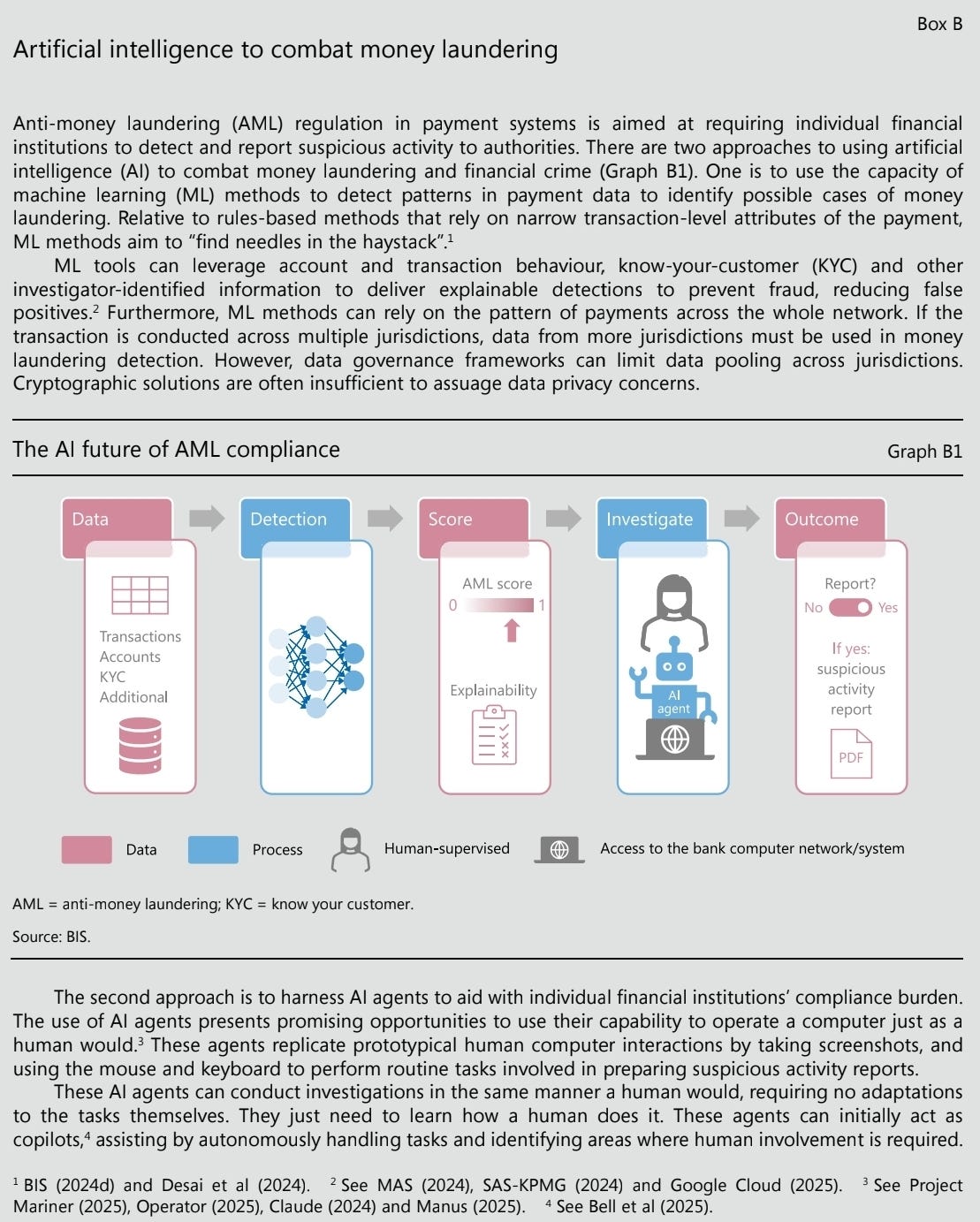

Tech can help, but only so much: Advances in AI and data integration (e.g., machine learning to reduce false positives and enhance detection) can aid in fighting financial crime. But as the BIS notes, even with these tools, the bearer nature of stablecoins means that full integrity is hard to guarantee at scale.

Additional Concerns: Beyond Integrity

1. Monetary Sovereignty Under Threat

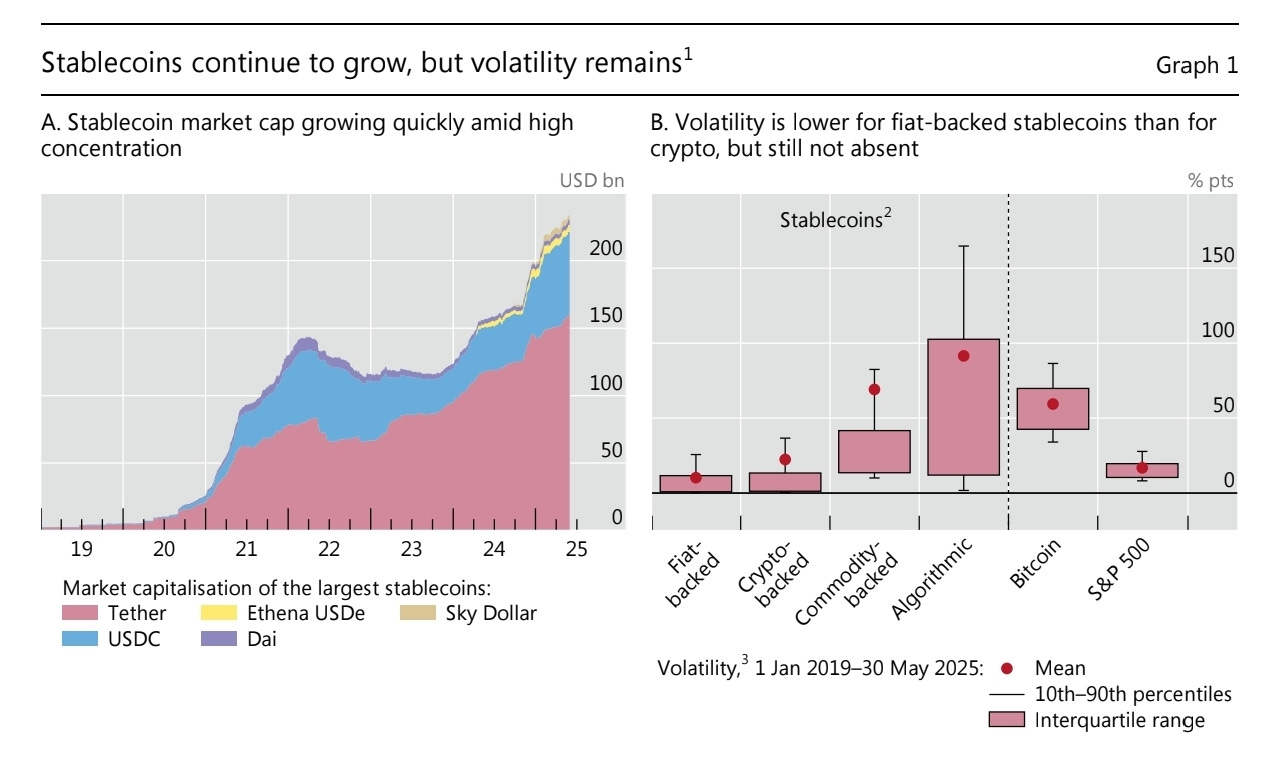

Dollar dominance: Over 99% of stablecoins are USD-pegged, with cross-border flows rising sharply (see Graph 2.A). As Graph 2.B shows, these flows spike in countries experiencing high inflation or FX volatility, making stablecoins a stealth vehicle for dollarisation. This undermines local monetary policy and can erode sovereignty, especially in emerging markets.

2. Market Impact and Financial Stability Risks

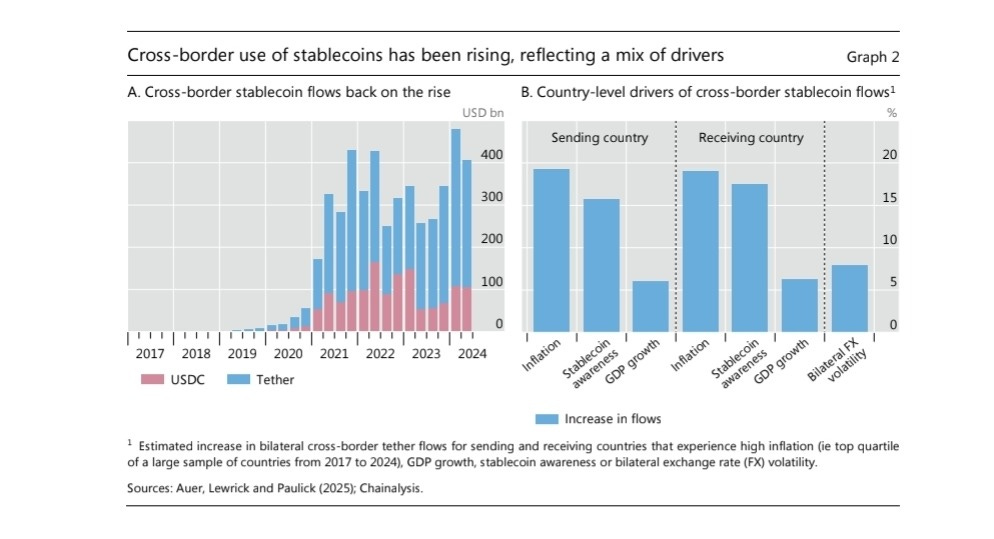

Treasury market footprint: Stablecoins are now among the largest buyers of short-term US Treasuries, rivaling major money market funds (see Graph 3.A). BIS research finds that inflows into stablecoins can lower three-month Treasury yields by 2–2.5 basis points, while outflows can raise yields by 6–8 basis points (Graph 3.B and 3.C). This asymmetric effect means that a run on stablecoins could quickly destabilize Treasury markets, amplifying financial shocks.

3. Business Model Tensions

Profit vs. stability: Stablecoin issuers face a trade-off: to maximize profits, they may invest reserves in assets with some credit or liquidity risk, but this undermines their ability to guarantee stability during stress. Fully backing coins with risk-free central bank reserves would reduce risk but also squeeze profits, making the business model less attractive.

Policy Approaches to Stablecoins: Building Trust in a Borderless Era

The BIS’s message is clear: If stablecoins are to play a meaningful role in the financial system, they must be regulated with the same rigour as traditional financial products—anchored in the principle of “same activity, same risk, same regulatory outcome.” This technology-neutral approach avoids distorting competition and ensures a level playing field, even as the underlying tech evolves.

Key Pillars of Effective Regulation

1. Integrity and Financial Crime Prevention

KYC/AML compliance is non-negotiable. Most jurisdictions now require exchanges and wallet providers to meet standards similar to banks. Some go further, applying the “travel rule” to unhosted wallets, requiring beneficiary information to follow transactions.

Blockchain analytics and collaboration with law enforcement can help track illicit flows, but these measures only mitigate—not eliminate—the risks, especially given the scale and speed of blockchain transactions.

Default KYC: A robust approach could see all stablecoin addresses blocked unless KYC is verified, bringing them squarely within the scope of AML/CFT frameworks.

2. Stabilisation and Asset Backing

Quality and transparency of reserves are paramount. Regulators are increasingly focused on requiring high-quality liquid assets (think short-term Treasuries, as shown in Graph 3.A), regular audits, and public disclosures.

No interest payments: Many jurisdictions prohibit paying interest to stablecoin holders, aligning them with e-money or MMFs and discouraging speculative flows.

Learning from MMFs and PSPs: Stablecoins’ structure is similar to money market funds and pre-funded payment service providers, which are tightly regulated for liquidity and transparency.

3. Cross-Border Coordination

Borderless challenges: Stablecoins’ global reach means regulatory arbitrage is a real risk. Without international coordination, issuers may gravitate to the weakest regulatory regimes.

Local incorporation: The EU, Japan, and Singapore now require stablecoin issuers to establish local entities and obtain authorisation, helping to bring them within the regulatory perimeter.

Global standards: Over 60% of central banks surveyed by the BIS are developing or have implemented stablecoin frameworks, focusing on asset backing, disclosure, consumer protection, and financial stability.

4. Technology-Neutral, Proportional Oversight

Regulation should not target the tech itself, but the risks and outcomes. This ensures innovation isn’t stifled while upholding market integrity.

Project Pyxtrial and new tech: Supervisory technology can help regulators monitor compliance in real time, especially for reserve management.

5. Addressing Unique Risks

Irreversibility and operational risk: The immutable nature of blockchains means mistaken or fraudulent payments are difficult to reverse, raising the bar for consumer protection.

Dollarisation and monetary sovereignty: As Graph 2 shows, stablecoins are driving stealth dollarisation, especially in high-inflation economies. This raises policy questions for emerging markets about how to maintain monetary control.

Tokenisation is shaping up to be the next big leap for money and payments. Unlike simple digital entries, tokens actually bundle the asset’s record with the rules for how it can be used or transferred. This means actions like “delivery versus payment” (DvP)—where a payment only goes through if the asset is delivered, and vice versa—can be automated, slashing counterparty risk and eliminating manual reconciliations. For both businesses and households, this opens the door to new efficiencies, from smoother cash flow management to potentially higher returns on investments like pensions.

The real game-changer is the idea of a unified ledger: a single digital platform where tokenised central bank reserves, commercial bank money, and other assets all interact seamlessly. By combining programmability and automation, a unified ledger could make cross-border payments and capital market transactions nearly frictionless, with instant settlement and reduced risk. Ultimately, tokenisation could unlock entirely new financial products and services—limited only by the imagination of developers building on this digital foundation.

Tokenisation of the Two-Tier Monetary System: A Step Change for Payments

Tokenisation has the potential to overhaul how money moves through our financial system, but it doesn’t mean throwing out what already works. Instead, it upgrades the two-tier structure—where commercial banks and the central bank each play their part—by making payments faster, safer, and more efficient.

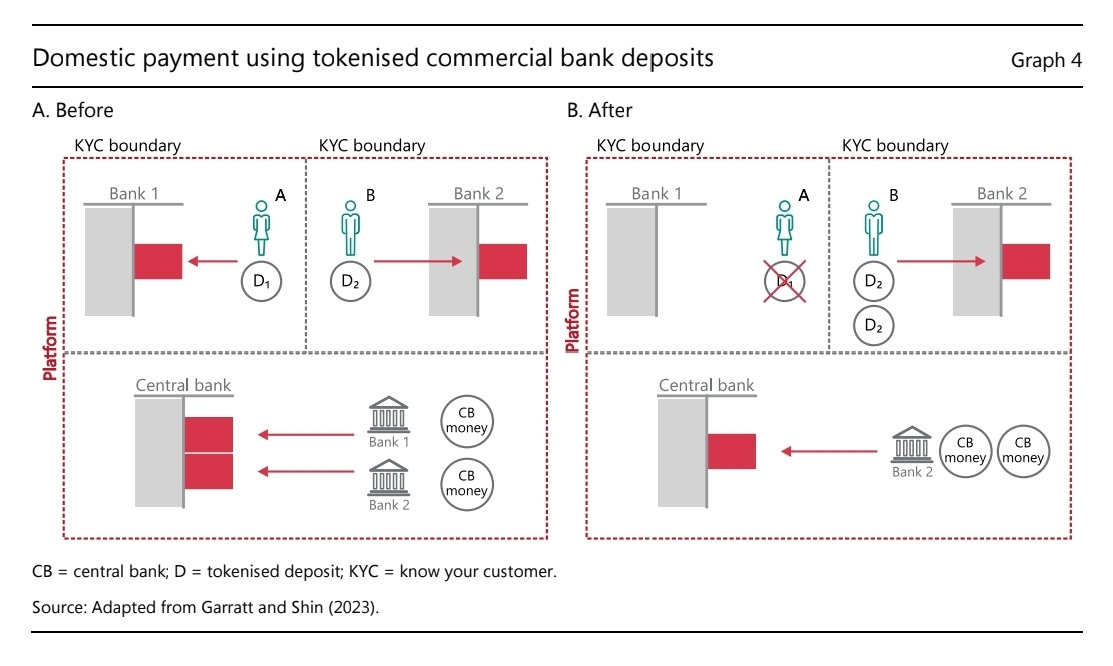

Let’s break it down with the example from Graph 4. Today, even a simple payment from Maria (at Bank 1) to Sven (at Bank 2) involves several steps: Maria’s account is debited, Sven’s is credited, and the banks settle up using central bank reserves. Traditionally, this process is split across separate systems, requiring messaging, reconciliation, and time.

Enter tokenisation

With tokenised commercial bank deposits, all these steps can happen together—instantly and atomically—on a programmable platform. In Graph 4A (“Before”), we see Maria holding a tokenised deposit (D1) at Bank 1 and Sven holding D2 at Bank 2, with the banks’ reserves sitting at the central bank. In Graph 4B (“After”), when Maria pays Sven, her token is deleted, a new token is created for Sven, and the corresponding central bank reserves move seamlessly between the banks. The entire process is bundled into a single, automated transaction—no manual reconciliation needed.

Crucially, this model preserves the strengths of the two-tier system. There’s no new credit risk between banks, and settlement in central bank reserves ensures that every payment is executed at par, maintaining the singleness of money. By applying the same regulatory standards and safeguards to all issuers, including non-banks, tokenisation could also open the door to more competition and greater financial inclusion.

In short: tokenisation doesn’t just digitise money—it synchronises and secures the entire payment chain, making the system more robust and accessible without sacrificing trust or stability.

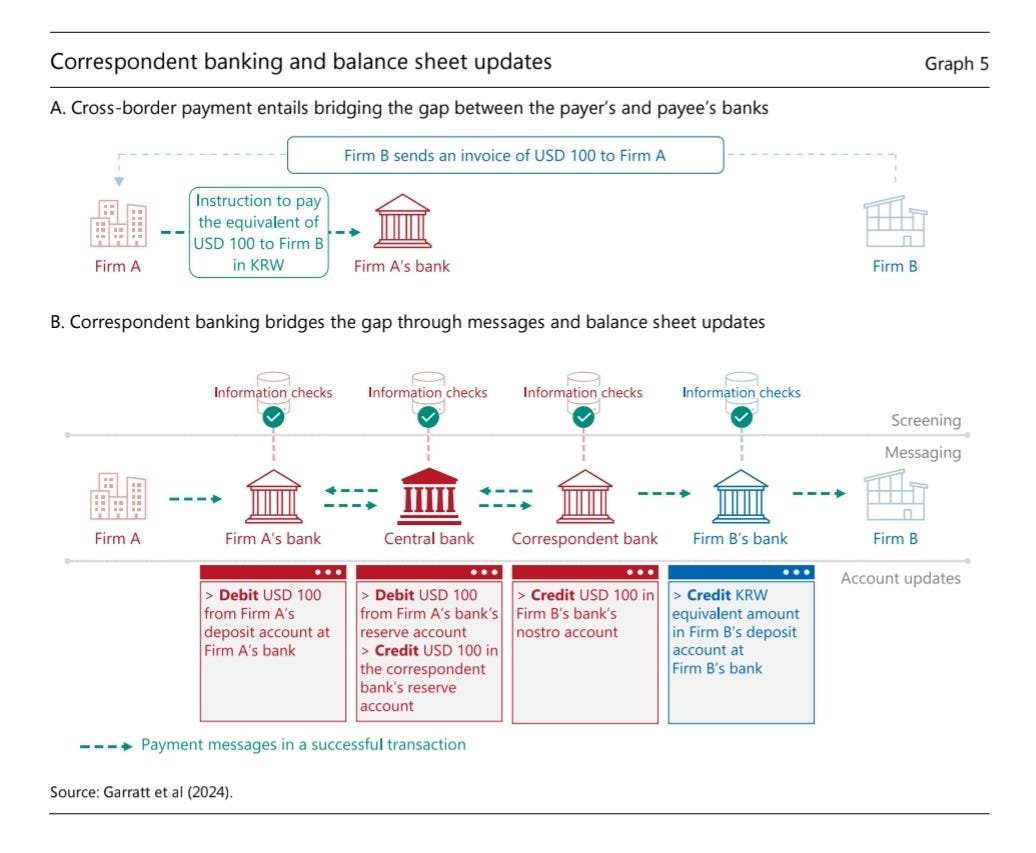

Today’s cross-border payments are riddled with friction—think delays, settlement risks, and operational headaches—because messaging, reconciliation, and settlement all happen in separate, often incompatible systems. When you send money internationally, your payment hops through a chain of correspondent banks, each updating their own accounts (nostro/vostro) and relying on a web of messages and reconciliations. If the payment involves different currencies, things get even more complex, as there’s no single settlement asset spanning the entire transaction chain.

Graph 5 (A and B) provides a brilliant illustration of this complexity.

Graph 5.A shows the straightforward case of a domestic USD payment between two firms using US banks, settling directly via the Federal Reserve. Simple, efficient.

Graph 5.B then unpacks the convoluted reality of a cross-border payment: Firm A in the US paying Firm B in Korea in KRW. Instead of a direct transfer, the USD payment first goes from Firm A’s bank to a US correspondent bank, settling in USD with the Federal Reserve. This correspondent bank then updates its internal ledger (crediting the Korean bank’s USD account), and only then does the Korean bank confirm and convert it to KRW for Firm B. Crucially, no actual money crosses borders; it’s a series of account updates and currency conversions, involving multiple messages and separate settlements. This multi-step process introduces delays, costs, and risks.

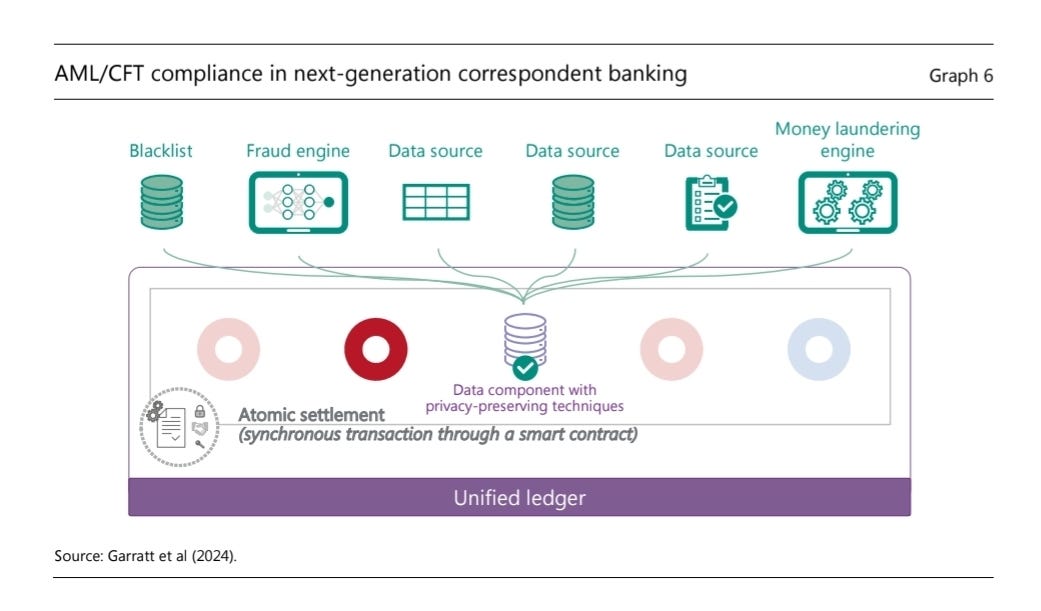

Now, imagine applying tokenisation and a unified ledger to this. Instead of a relay race of messages and reconciliations, a unified ledger would bring together tokenised central bank and commercial bank money on a single platform. All critical steps—payment instructions, settlement, compliance checks—could be bundled into one smart contract-driven transaction. This would allow for:

Single-step execution: Payment instructions and account updates happen in one go, eliminating the need for multiple messaging systems.

Atomic settlement: All parties approve the transaction before it settles, so there’s no risk of only part of the payment going through. Graph 6 (not provided here, but described in the text) would illustrate how this unified, programmable ledger brings together payment instructions, settlement, and post-transaction monitoring into a single, atomic operation.

Integrated compliance: AML/CFT checks can be embedded directly into the transaction process, with AI helping to spot suspicious patterns and reduce false positives.

The BIS highlights the need for flexibility to accommodate different jurisdictions and regulatory approaches, but also enough harmonisation to ensure everything works together (composability). Data protection and governance are critical, especially since countries have different rules about where and how data can be stored and accessed. Some might prefer a single shared ledger, while others will want separate ledgers connected by secure bridges.

Project Agorá is a live example of this vision. It brings together seven central banks and 43 financial institutions, experimenting with tokenised money across borders while maintaining the core strengths of the current two-tier system. The project’s architecture will need to balance programmability and efficiency with strong governance and data privacy controls, using permissioned DLT to ensure only authorised parties can access sensitive information.

Beyond Money: Tokenisation of Government Securities

The BIS envisions a unified ledger that doesn’t just modernise payments, but also revolutionises securities markets by bringing money and assets—like government bonds—onto the same programmable platform. In this system, central bank reserves, commercial bank deposits, and government bonds are all tokenised, making financial claims “executable objects” that can be transferred and managed automatically.

Historically, securities settlement evolved from slow, paper-based processes to electronic bookkeeping, but today’s system still relies on a complex web of intermediaries, reconciliations, and delays. Tokenisation promises to simplify this by enabling atomic, instant settlement of both money and securities, reducing operational risks and costs.

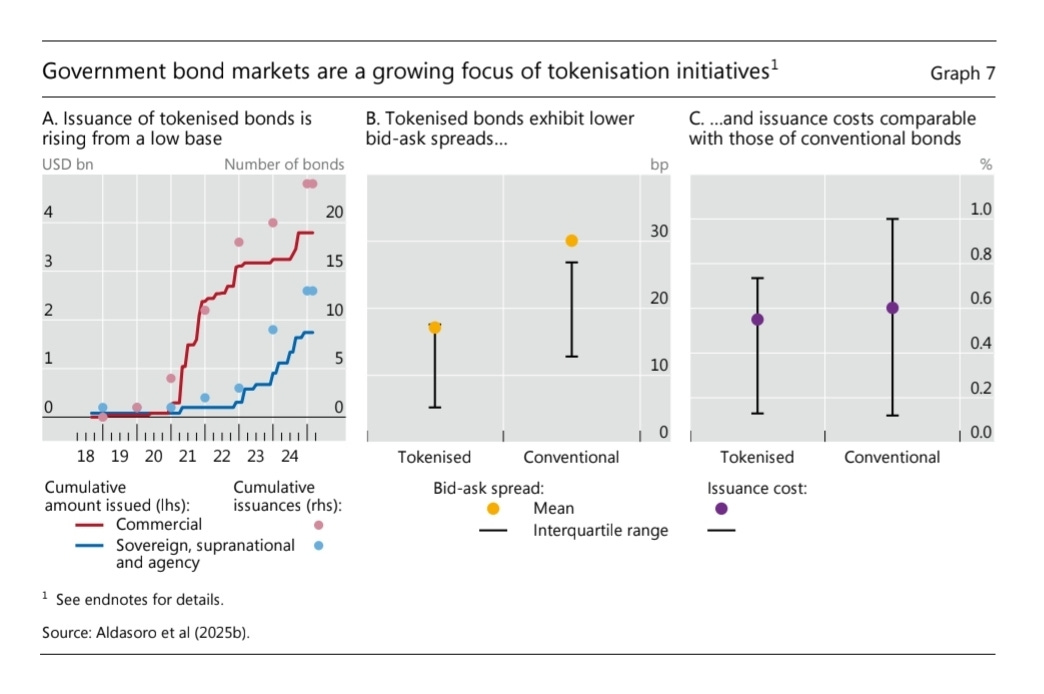

Graph 7 in the BIS report captures the early momentum in this space:

Graph 7.A shows that more than $4 billion in tokenised sovereign, supranational, and agency (SSA) bonds have already been issued across nine currencies, demonstrating growing global interest.

Graph 7.B and 7.C reveal that tokenised bonds are already competitive with conventional bonds, offering similar issuance costs and, notably, tighter bid-ask spreads (17 basis points for tokenised bonds versus 30 for traditional ones). This suggests that tokenisation may enhance liquidity and efficiency in government securities markets.

The potential goes further. Tokenisation can automate complex operations like collateral transfers and repo transactions, enabling instant, programmable movement of assets and payments. This is especially valuable in the massive repo market, where even small efficiency gains could translate into substantial cost savings and risk reduction.

Central banks are already experimenting with these concepts—Project Promissa, for example, is digitising government promissory notes to improve transparency, efficiency, and collaboration across borders.

Tokenisation is moving from theory to practice in government securities markets. While legal and regulatory challenges remain, the early data suggest that tokenised bonds can match or even surpass traditional instruments in cost and liquidity. As the ecosystem matures, the “tokenised trilogy” of central bank reserves, commercial bank money, and government bonds could reshape how markets operate, delivering tangible benefits for institutions and end users alike.

Assessing the Benefits of a Tokenised Financial System: Insights from Project Pine

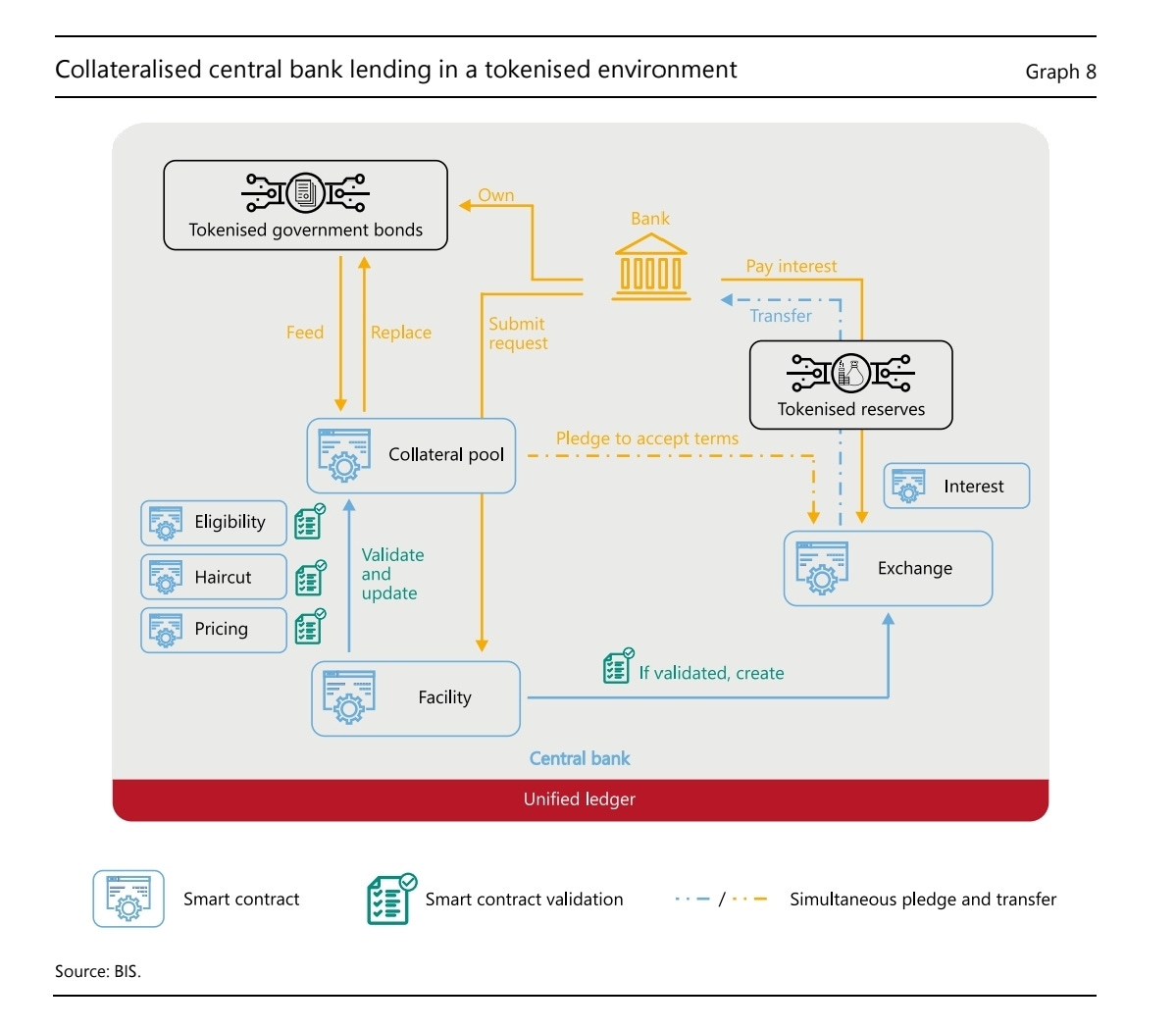

Project Pine—a collaboration between the New York Fed and the BIS Innovation Hub—offers a glimpse into the future of central banking in a fully tokenised financial system. The project simulates how monetary policy could work when central bank reserves, commercial bank deposits, and other financial assets are all tokenised and managed via smart contracts on a unified, programmable ledger.

Graph 8 visually breaks down this process using a tokenised repo transaction as an example. Here’s how it works:

Liquidity on Demand: Banks in need of liquidity can request tokenised central bank reserves, pledging tokenised collateral (like government bonds) through a smart contract-based collateral pool.

Automated Eligibility & Valuation: The central bank’s smart contracts instantly check the bank’s access rights, collateral eligibility, and apply any necessary haircuts—processes that today require manual review and are often published as static files.

Instantaneous Exchange: Upon approval, the smart contract locks the collateral, and the reserves are transferred instantly to the requesting bank. Throughout the repo’s life, pricing contracts keep market values and eligibility updated in real time.

Flexible Collateral Management: If the bank wants to swap collateral during the repo, it can do so seamlessly—again, all managed by smart contracts.

Automated Maturity: At repo maturity, repayment of reserves (with interest) triggers the automatic release of collateral.

Key Benefits Highlighted by Project Pine and Graph 8:

Speed and Flexibility: Central banks can instantly deploy new facilities, tweak parameters, or respond to market shocks with real-time data and programmable tools.

Operational Efficiency: Tasks like collateral management, interest accrual, and eligibility checks are automated, freeing up staff for higher-value work.

24/7 Market Operations: Tokenised platforms can, in principle, operate around the clock, supporting continuous market access.

Enhanced Transparency and Trust: Unified ledger data provides a real-time, consolidated view of market participants’ positions, supporting better policy responses and risk management.

Challenges Remain:

Transitioning to a tokenised system will require interoperability with legacy infrastructure, new booking and reconciliation processes, and robust solutions for collateral mobility and network fragmentation. But with central banks leading the way—offering tokenised reserves and facilities—industry adoption could accelerate, ensuring these innovations align with public policy goals like financial stability and effective monetary policy.

Final thoughts from InstitutionalFi on the BIS report:

While new technologies like stablecoins have sparked demand for more flexible and programmable money, the report makes clear that these private currencies still fall short on core requirements like trust, singleness, and systemic integrity—even with tighter regulation. The real promise lies in tokenisation built on unified ledgers, where central bank reserves, commercial bank deposits, and government securities can interact seamlessly, unlocking efficiency and new possibilities for the financial system. As shown in Graph 4, such innovations can simplify payments and settlement, but making this future a reality will require central banks to lead—setting standards, ensuring interoperability, and fostering trust. Ultimately, the next-generation monetary system will only be as strong as the public institutions guiding its evolution, balancing innovation with the stability and reliability that money demands.