Inside the Crypto

Bitcoin’s New All-Time High: What’s Next for Crypto?

Crypto Markets

It’s a bell-ringing week in London, and there’s no mistaking why. Bitcoin has blasted through its previous ceiling, posting a new all-time high of $125,689 on October 5, 2025, with Bloomberg and several other major sources confirming the top. In a display of classic crypto humour, $69 left its mark as the cycle's local top trade. The record week closed with Bitcoin at $123,545, up 3.3% from the week prior, while open interest surged on high-leverage shorts—an unmistakable signal that traders are hedging this historic momentum.

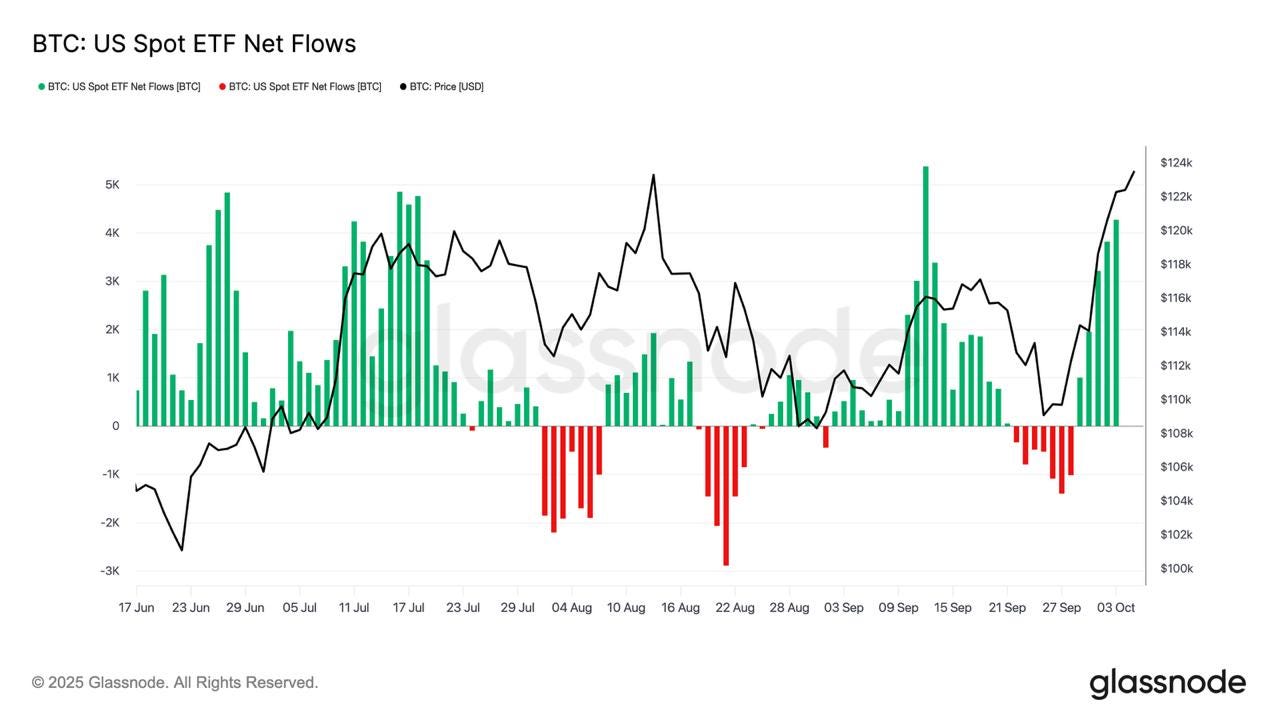

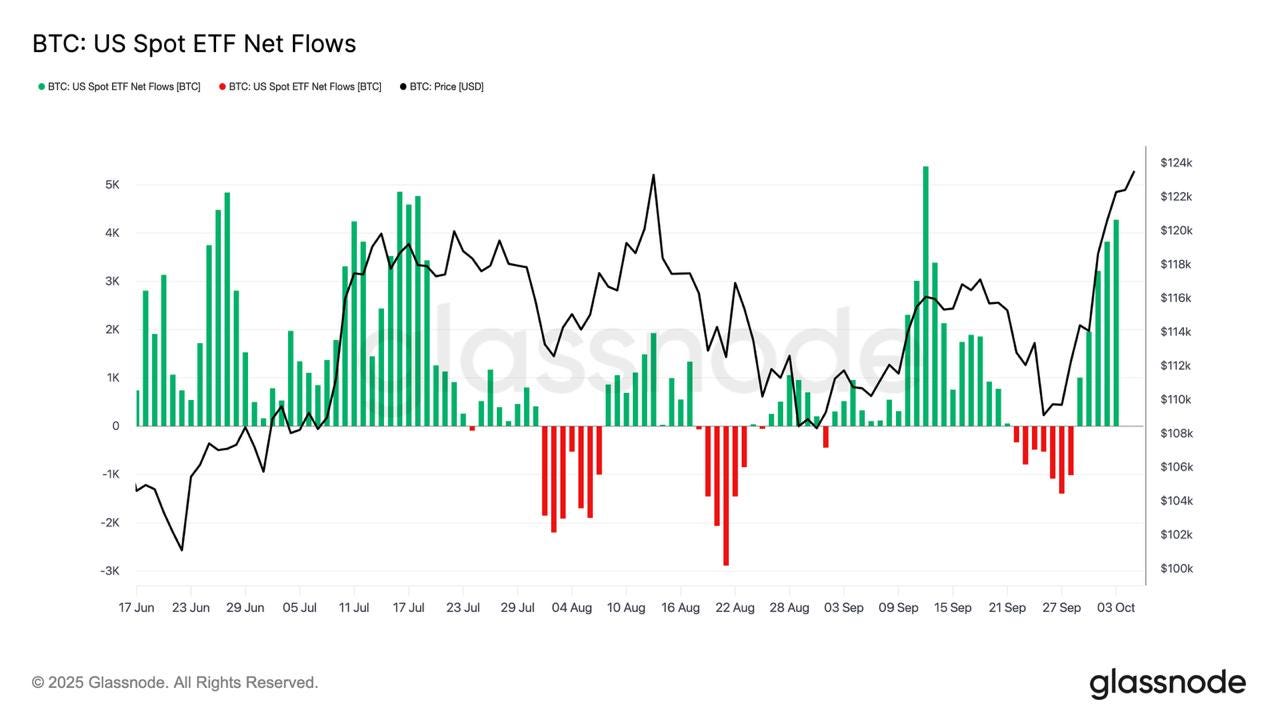

Spot Bitcoin ETFs catalysed much of this action, attracting $3.24 billion of fresh funds last week—second only to the all-time record inflow. Glassnode points out that these sharply positive flows reflect renewed institutional conviction, providing structural support as Q4 begins

.

Across the aisle, Ethereum did not print a new ATH but demonstrated significant follow-through. ETH sits at $4,560, up 10% since the "crypto blast Wednesday" call, with bulls watching the move above the monthly trendline for potential reversal confirmation. Ethereum spot ETFs saw $1.3B in net inflows, as all nine products posted positives for the week.

Key Headlines

Regulatory Pause: The ongoing U.S. government shutdown has delayed the SEC’s routine ETF approvals, impacting new listings for assets such as LTC, SOL, and XRP. Emergency actions remain possible, but expect little movement until normal operations resume.

Samsung x Coinbase: Samsung and Coinbase announced an integration bringing crypto trading, payments, and staking to Samsung Wallet on Galaxy devices—potentially reaching 75 million U.S. users, with promises for global rollout.

Ethereum Foundation Treasury Shift: The EF will convert 1,000 ETH into stablecoins using CoWSwap’s TWAP function, consistent with its treasury policy for maintaining fiat buffers supporting R&D, grants, and donations.

Coinbase Pursues National Trust Charter: Coinbase filed for an OCC national trust charter—joining Circle, Paxos, and Ripple—and clarified that while it’s not seeking a bank licence, tougher compliance frameworks are crucial for sector innovation and security.

Tether and Antalpha: Tether is in funding talks with Antalpha to build a $200M digital asset vehicle focusing on XAUt, their gold-backed token. Antalpha’s September announcement included vault expansion plans and new lending products tied to Tether Gold.

Trump-Linked WLFI: The Trump family-associated WLFI token sold treasury tokens to Hut8 at $0.25 each, emphasising no new issuance or dilution.

BAYC Legal Win: A California federal judge dismissed a securities lawsuit against Yuga Labs, affirming that Bored Ape Yacht Club NFTs and ApeCoin do not meet the Howey test for securities, reinforcing their status as digital collectibles.

Aptos ETF Move: Bitwise CEO announced the S-1 filing for an Aptos ETF, citing major momentum as Aptos climbed 25% MoM.

VanEck Ethereum Report: Data shows institutional ETH staking growth presents dilution risk for non-staking holders, while the December “Fusaka” upgrade aims to lower Layer-2 fees and allow probabilistic sampling to validate blocks.

FTX Saga: SBF, in a rare prison interview, said that handing FTX over to John J. Ray III was his “biggest mistake”, as Ray’s team managed the subsequent bankruptcy and over $171M in legal fees to Sullivan & Cromwell.

Discord Breach: A hack at a third-party Discord vendor exposed user data, including names, emails, chat logs, IP, and some payment details—Discord confirmed its own systems remained uncompromised.

Rouble Stablecoin Controversy: The sanctioned rouble-backed stablecoin A7A5 surfaced as a “platinum sponsor” at TOKEN2049, before its booths were removed post-inquiry. Over $70.8B has been transferred via A7A5, mostly routed through Asia, Africa, and Latin America.

The crypto market is hitting escape velocity as ETF-driven institutional demand collides with a macro landscape hungry for alternative yield, regulatory clarity, and new blockchain infrastructure narratives. Stay tuned—this quarter is poised to test the limits of what digital assets can achieve.