Inside the Crypto Sector

Structural Adoption, Cyclical Fragility

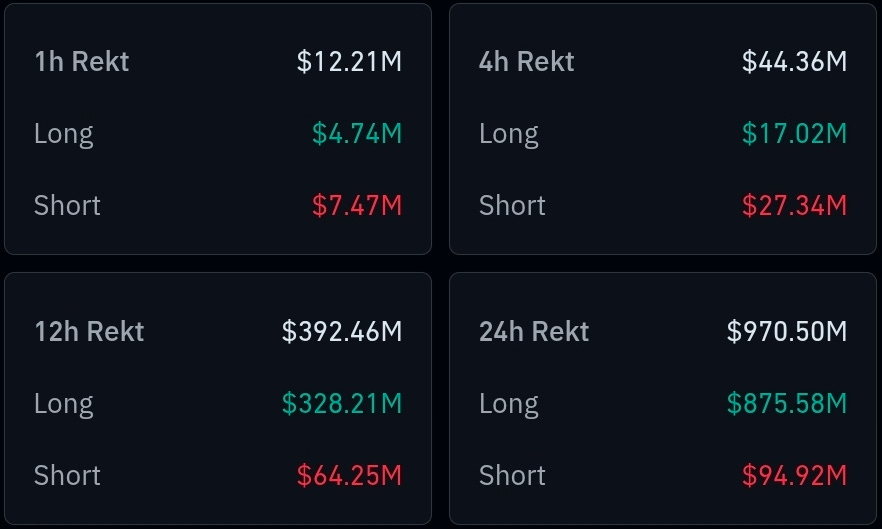

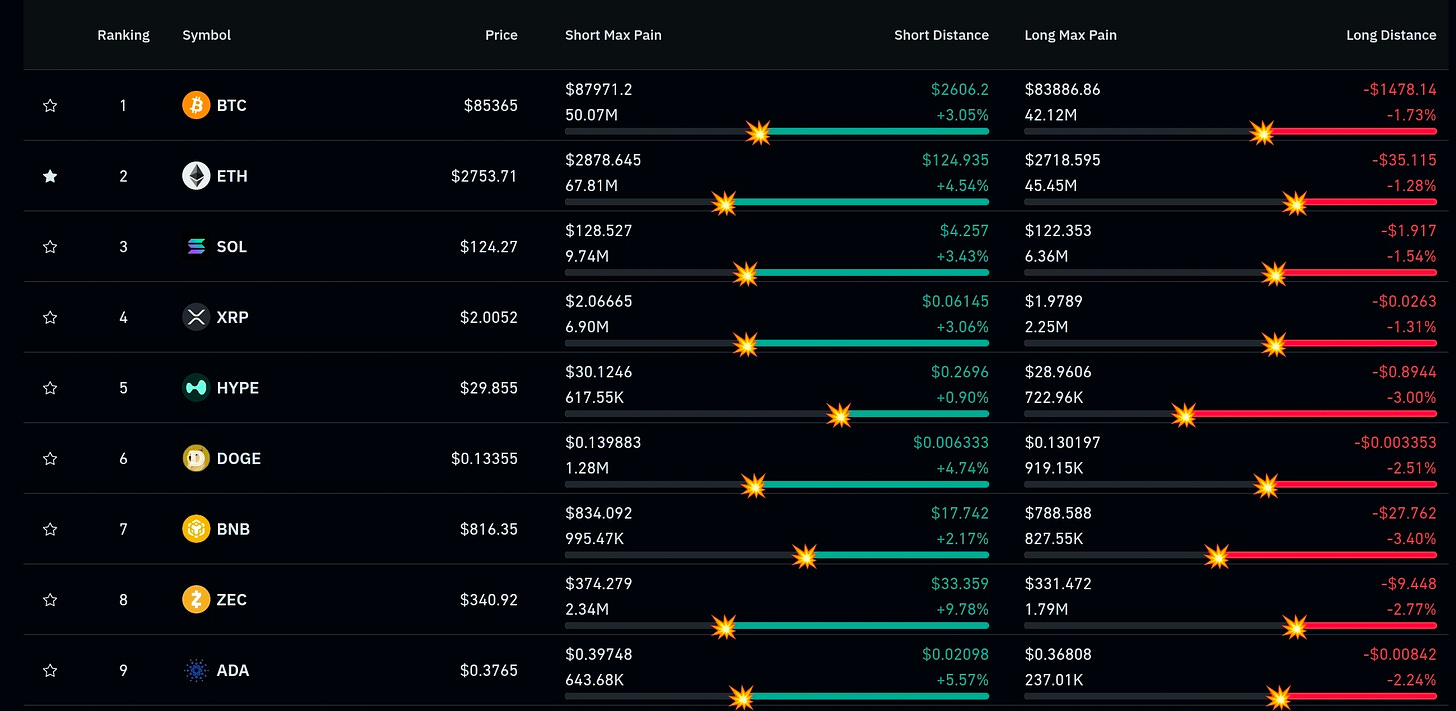

The crypto market just delivered a sharp reminder that this market dynamic has changed. BTC has broken back below $85,000 and ETH has slipped under $2,800, with roughly $929 million wiped out in 24‑hour liquidations – and nearly all of that pain sitting on the long side. The move caps a November that already saw a 26.7% drop in global spot volumes to $1.59 trillion and a 30% MoM decline in DEX activity to roughly $398 billion, taking us back to June‑like liquidity conditions.

Macro, interestingly, is not the obvious villain. QCP frames the latest leg down as an Asia‑driven shock: hawkish BOJ tones and weak China PMIs hit risk during thinner Asian liquidity, while systematic strategies watched BTC’s recent highs and mNAV bands like tripwires. In other words, this wasn’t the Fed tightening the screws – it was a reminder that BTC now trades as a fully global macro asset, with Asian session shocks increasingly decisive around key levels.

Under the surface, structural flows are soft. Spot BTC ETF demand has cooled, November volumes slumped, and the market is now trying to digest a meaningful unlock calendar. One‑off unlocks in ENA and EIGEN sit alongside daily linear unlocks in SOL, WLD, AVAX, DOGE and others, adding over $200 million of potential sell‑pressure in a week where liquidity is already thin. In this environment, the key question is simple: can BTC defend its recent lows long enough for funding to reset, forced longs to clear, and fresh spot buyers to step back in?

Meanwhile, the regulatory perimeter keeps tightening. Coinbase’s latest transparency work shows a record 12,716 government information requests, up 19% year‑on‑year, with 53% now coming from outside the US and countries like France more than doubling their inquiry count. At the same time, German and Swiss authorities have jointly dismantled a major Bitcoin mixing operation, seizing tens of millions in assets and a trove of operational data – a short‑term blow to ransomware and darknet users, but almost certainly a catalyst for migration to alternative privacy rails rather than a true shutdown of illicit demand.

On the “inside baseball” side of the balance sheet, the Tether debate has re-entered the conversation. Critics like Arthur Hayes continue to flag solvency and systemic‑risk concerns, while defenders point to Tether’s asset stack – Treasuries, equity stakes, mining investments, and retained earnings – and the enormous carry the firm earns from short‑dated US government debt. Functionally, the largest crypto dollar is now levered to US monetary policy in a way that should make macro PMs pay attention.

The most under‑appreciated development, however, is regarding sovereign developments. The Czech National Bank has publicly modelled BTC as part of its reserve mix: internal work suggests that a 5% BTC allocation over the last decade would have added roughly 3.5 percentage points to annual returns at the cost of roughly doubling volatility, while a 2.5% allocation to a BTC ETF delivered return improvements comparable to raising US equities from 38% to 50% of the portfolio, but with less additional volatility. For a central bank to say, in plain terms, “BTC screens better than more equities at the margin” is a regime shift the market has not fully priced.

For professionals inside the sector, the through‑line is clear: this is a market where price is still dominated in the short term by leverage, ETF flows, and Global‑session macro shocks – but the ownership base is quietly institutionalizing at the sovereign and TradFi level, under increasing regulatory surveillance and enforcement. That mix creates a paradoxical setup: structurally stronger hands, cyclically fragile liquidity. Translating that into positioning likely means respecting the downside tails around key support zones while recognizing that, for the first time, central banks are not just watching Bitcoin – they are backtesting it into their own balance sheets.

I hope you have enjoyed tonights edition to ‘Inside the Crypto Sector’, please support the page by pressing the subscibe burron and if you would like to support even further, you can upgrade to be a paid sub!