The Digital Asset Primer: Bitcoin vs Ethereum

Bitcoin vs. Ethereum: A Trader’s Guide to Crypto’s Biggest Rivalry and Risk Management

The Digital Asset Primer: Bitcoin vs. Ethereum

The digital asset landscape is dominated by two giants: Bitcoin and Ethereum. Though both are built on blockchain technology and share the vision of decentralization, their philosophies, technical designs, and real-world uses diverge significantly. Understanding these differences is essential for anyone looking to navigate crypto markets, whether you’re a professional trader, a retail investor, or simply curious about the future of digital finance.

Why Subscribe?

By subscribing, you’ll never miss an update—get insightful primers, market analysis, and actionable strategies delivered straight to your inbox, completely free, or upgrade to a premium member for exclusive content. You’ll join a community of traders, investors, and crypto enthusiasts who value clear, unbiased information and practical guidance. Whether you’re a seasoned pro or just starting your crypto journey, your subscription keeps you ahead of the curve and ensures you’re always informed when new content drops. Subscribe now and stay in the know!

Core Philosophies: A Tale of Two Visions

Bitcoin was born out of a desire to create a decentralized alternative to traditional money—free from government control and censorship. Its creator, Satoshi Nakamoto, envisioned Bitcoin as a peer-to-peer electronic cash system, but over time, it has come to be seen primarily as “digital gold”—a store of value and hedge against inflation. The Bitcoin community places a premium on security, simplicity, and predictability. Changes to its protocol are rare and carefully considered, reflecting a conservative approach to development.

Ethereum, on the other hand, was designed as a platform for programmable contracts and decentralized applications (dApps). Its founder, Vitalik Buterin, saw the potential for blockchain to be more than just a ledger for money. Ethereum’s goal is to serve as a “world computer,” enabling developers to build everything from decentralized finance (DeFi) platforms to digital collectibles (NFTs) and beyond. The Ethereum community is more experimental, embracing frequent upgrades and new features to expand the platform’s capabilities.

Technical Foundations: How They Work

Blockchain Architecture 🔗

Both Bitcoin and Ethereum use distributed ledger technology, but their architectures are tailored to their respective goals. Bitcoin’s blockchain is purpose-built for secure, transparent, and immutable value transfer. Each block contains a list of transactions, and the network is maintained by a global network of nodes that validate and relay transactions.

Ethereum’s blockchain is more flexible, supporting not just transactions but also programmable logic through smart contracts. This allows for the creation of complex applications that run autonomously on the network. The Ethereum Virtual Machine (EVM) executes these smart contracts, making Ethereum a foundational layer for the broader Web3 ecosystem.

Consensus Mechanisms

- Bitcoin: Uses Proof of Work (PoW), where miners compete to solve cryptographic puzzles. The winner adds a new block to the chain and is rewarded with newly minted Bitcoin. This process is highly secure but energy-intensive, requiring vast amounts of computational power.

- Ethereum: Originally used PoW, but in 2022, it completed “The Merge” and transitioned to Proof of Stake (PoS). In PoS, validators stake their Ether as collateral to propose and validate blocks. This switch reduced Ethereum’s energy consumption by over 99% and improved scalability, aligning with its goals of sustainability and innovation.

Transaction Speed and Scalability

Bitcoin’s block time is about 10 minutes, meaning transactions can take a while to confirm, especially during periods of high demand. Its block size is limited to about 1MB, which restricts the number of transactions processed per block and can lead to congestion and higher fees[4][5]. Ethereum, by contrast, has a block time of about 12 seconds, allowing for much faster confirmations and higher throughput. Both networks use additional solutions to scale: Bitcoin relies on off-chain solutions like the Lightning Network, while Ethereum uses Layer-2 rollups and is planning further upgrades like sharding to increase capacity.

Economic Models: Supply and Incentives

Bitcoin has a fixed supply of 21 million coins, making it inherently scarce. Every four years, the block reward for miners is halved in an event known as the “halving,” which reduces the rate at which new Bitcoin is created. This predictable, disinflationary model reinforces Bitcoin’s status as a store of value and digital gold.

Ethereum does not have a fixed supply cap. New Ether is issued to validators as a reward for securing the network, but since the introduction of EIP-1559, a portion of transaction fees is burned, which can make Ethereum’s supply deflationary during periods of high activity. This dynamic supply model is designed to balance incentives for validators while keeping inflation in check.

Use Cases: Beyond Money

Bitcoin is primarily used as a store of value and medium of exchange. Its simplicity and security make it attractive for long-term holding and as a hedge against inflation and currency devaluation. In recent years, innovations like Ordinals have allowed users to inscribe data (such as digital art) onto Bitcoin’s blockchain, expanding its use cases, but these are still niche compared to Ethereum’s ecosystem.

Ethereum is the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), and a wide range of dApps. Its smart contract functionality enables developers to build everything from decentralized exchanges to lending platforms, digital art marketplaces, and even virtual worlds. Ethereum’s flexibility and programmability have made it the platform of choice for blockchain innovation.

Market Performance: Volatility and Trends

Both Bitcoin and Ethereum have experienced significant price volatility, but their market dynamics differ. Bitcoin is generally less volatile than Ethereum, especially during periods of market uncertainty, and is often seen as a “safe haven” asset within crypto. Its price has shown resilience after major events like the 2024 halving and the launch of U.S. spot Bitcoin ETPs.

Ethereum, while more volatile, offers higher growth potential due to its role as the foundation for DeFi and NFTs. Its price is more sensitive to upgrades, regulatory news, and shifts in the broader crypto ecosystem. In recent years, Ethereum has seen dramatic swings, reflecting both its opportunities and risks.

Technical Breakdown

Transaction Speed and Block Time:

Bitcoin: ~10 minutes per block, ~7 transactions per second (base layer)

Ethereum: ~12 seconds per block, ~15-30 transactions per second (base layer)

Consensus Mechanism Comparison:

Bitcoin: Proof of Work (PoW) — miners solve puzzles, high energy use

Ethereum: Proof of Stake (PoS) — validators stake ETH, low energy use

Supply Dynamics:

Bitcoin: Fixed supply (21 million), halving every 4 years

Ethereum: Dynamic supply, fee burning (EIP-1559)

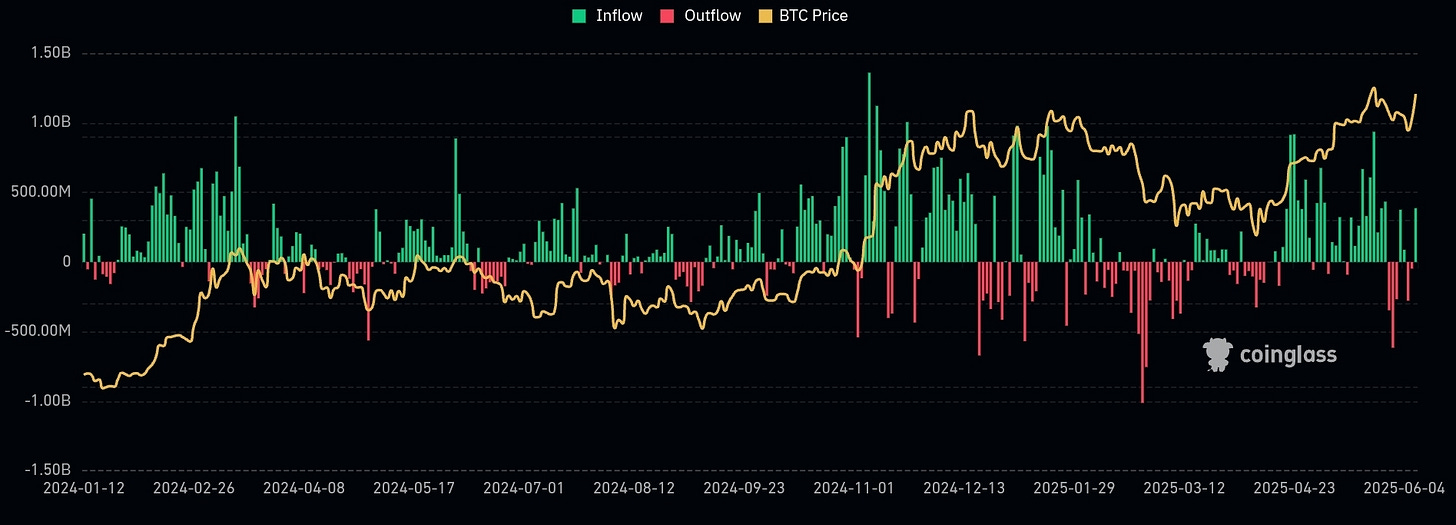

Bitcoin vs. Ethereum ETFs: Progress and Impact Since Launch

When spot Bitcoin ETFs debuted in the US in January 2024, the market’s reaction was nothing short of extraordinary—and for good reason. These products have not only shattered records for asset growth but have also fundamentally reshaped how both institutions and retail investors access digital assets. BlackRock’s IBIT, for example, amassed $70 billion in assets under management in just 341 days—a pace that eclipses even the most successful gold ETFs. Collectively, US Bitcoin ETFs have become the “marginal buyer” in the market, now holding around 3.7% of all Bitcoin in circulation—a larger share than gold ETFs hold of the gold market.

The institutional embrace has been striking. Major financial players like Morgan Stanley, Goldman Sachs, and even state pension funds have allocated over $100 million each into Bitcoin ETFs. This level of adoption has normalized Bitcoin as a mainstream asset class, and the ETFs’ influence on price and market activity is undeniable. On days of peak demand, inflows have topped $900 million in a single session—a testament to the appetite for regulated, accessible exposure to digital gold.

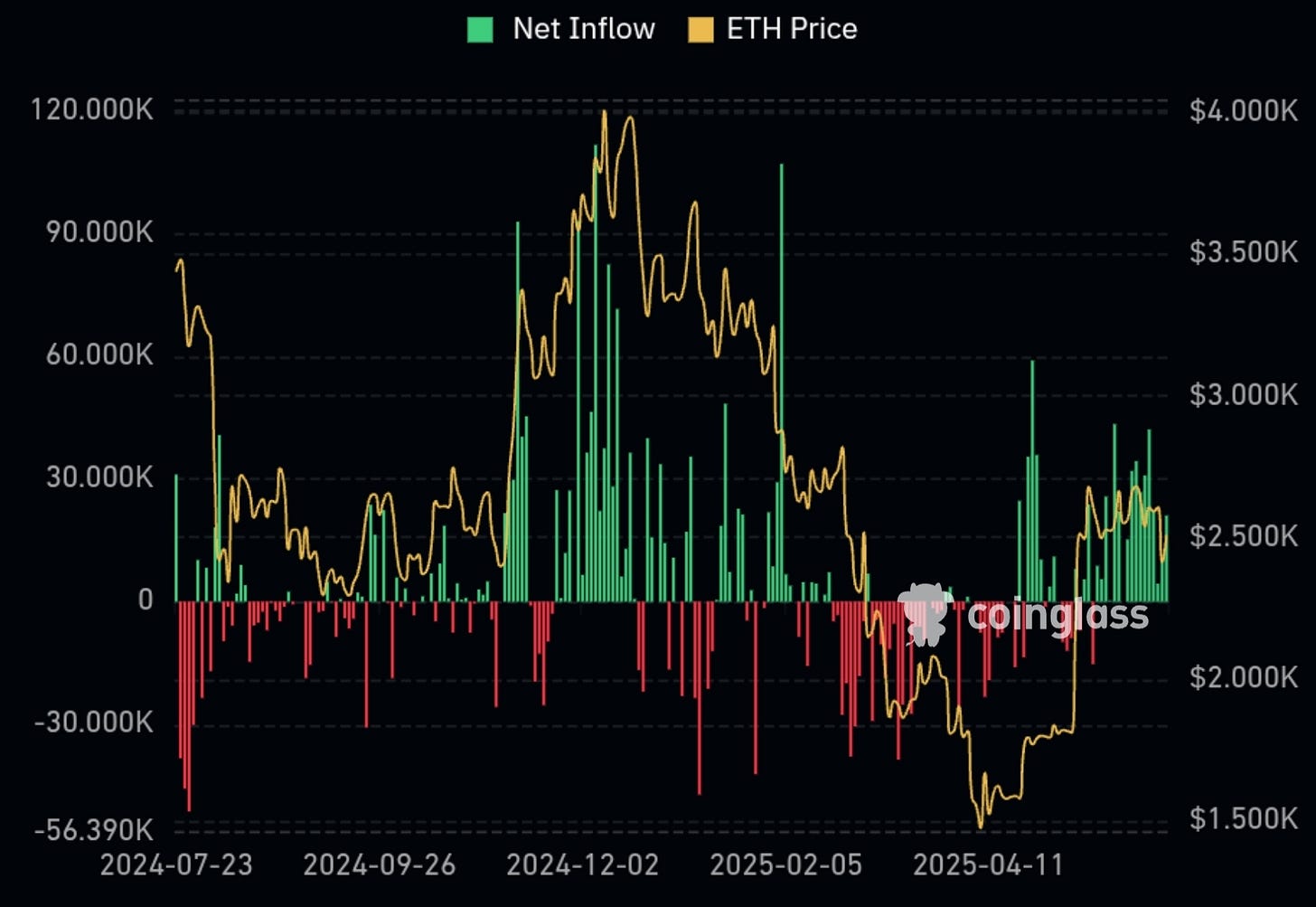

Ethereum ETFs, which launched a few months later in July 2024, have charted a different but increasingly promising path. While their total assets under management are still a fraction of Bitcoin’s, the momentum is unmistakable. Institutional ownership in Ethereum ETFs has surged from just under 5% to nearly 15% in recent quarters, a remarkable acceleration given the relatively short time frame. Over the past several weeks, Ethereum investment products have recorded consistent inflows, totaling $1.5 billion as of June 2025, with $296 million flowing in during the most recent week alone. Goldman Sachs and Millennium Management stand out as some of the largest institutional holders, signaling a growing vote of confidence in Ethereum’s long-term potential.

Unlike Bitcoin, whose ETF-driven demand is closely tied to its role as a store of value, Ethereum’s appeal is more closely linked to its utility as the backbone of decentralized finance and the broader Web3 ecosystem. This distinction is reflected in the price action: Ethereum’s value is more sensitive to developments in DeFi, NFTs, and regulatory clarity around staking—factors that can drive both rapid appreciation and heightened volatility.

In summary, while Bitcoin ETFs have set the standard for institutional adoption and market influence, Ethereum ETFs are quickly gaining ground, buoyed by strong inflows and rising institutional interest. Both have opened the door to a new era of crypto investing, making it easier than ever for investors of all stripes to participate in the digital assets.

Investment Perspectives: Which Is Right for You?

Bitcoin and Ethereum serve different roles in a digital asset portfolio. Bitcoin is ideal for those seeking a simple, secure, and scarce asset with a proven track record as a store of value. Its conservative development and predictable supply make it appealing for long-term investors.

Ethereum is better suited for those interested in the growth of decentralized applications and the broader Web3 ecosystem. Its innovative features and dynamic supply model offer higher growth potential but come with greater complexity and risk.

Many investors choose to hold both, balancing Bitcoin’s stability with Ethereum’s growth opportunities.

Hedging Strategies with CME Group Micro Futures and Options

For both professional and retail traders, managing risk is essential—especially in volatile markets. CME Group offers micro Bitcoin and micro Ether futures and options, which provide flexible, regulated tools for hedging and portfolio management.

What Are Micro Cryptocurrency Futures and Options?

- Micro Bitcoin Futures (MBT) and Micro Ether Futures (MET): Each contract represents a fraction (1/10th) of one Bitcoin or Ether, making them accessible for smaller portfolios.

- Options on Micro Futures: Allow traders to hedge against adverse price movements or speculate on volatility with defined risk.

How Can These Tools Be Used for Hedging?

1. Portfolio Protection:

Suppose you hold spot Bitcoin or Ether and want to protect against short-term downside risk. You can sell micro futures contracts equivalent to your holdings. If the market drops, gains on the futures position can offset losses on your spot holdings.

Example:

- You own 1 ETH.

- You sell 10 Micro Ether Futures (each represents 0.1 ETH).

- If ETH’s price falls, your futures position profits, balancing your spot losses.

2. Relative Value Trading (ETH/BTC Spread):

If you believe Ethereum will outperform Bitcoin, you can go long on Micro Ether Futures and short Micro Bitcoin Futures. This “spread trade” allows you to express a view on the ETH/BTC price relationship rather than directional market moves.

Example:

- Buy Micro Ether Futures

- Sell Micro Bitcoin Futures

- If ETH outperforms BTC, your spread position gains value.

3. Volatility Management with Options:

Options on micro futures let you hedge against large moves or profit from volatility. Buying puts can protect your downside, while selling covered calls can generate income.

Example:

- Buy a Micro Bitcoin Put Option to insure against a sharp drop in BTC price.

- Sell a Micro Ether Call Option against your spot ETH to earn premium income.

Why Use CME Micro Contracts?

- Accessibility: Smaller contract sizes mean lower capital requirements.

- Regulation: CME Group contracts are fully regulated, reducing counterparty risk.

- Flexibility: Suitable for both hedging and speculative strategies.

- Liquidity: Deep liquidity and transparent pricing.

Key Takeaways

- Bitcoin: Best for long-term, conservative investors seeking digital scarcity.

- Ethereum: Suits those interested in innovation and higher growth potential.

- Hedging: CME Group’s micro futures and options offer accessible, regulated tools to manage risk, hedge spot positions, or execute sophisticated trading strategies between Bitcoin and Ethereum.

Final Thoughts

Bitcoin and Ethereum are not competitors but complementary pillars of the digital asset world. Bitcoin is the bedrock of digital scarcity and security, while Ethereum is the engine of decentralized innovation. Understanding their differences empowers you to make informed decisions, whether you’re looking to invest, build, or simply learn more about the future of finance.

Disclaimer:

The information provided in this article is for educational and informational purposes only and does not constitute financial, investment, legal, or professional advice. Readers should conduct their own research and consult with qualified professionals before making any financial or investment decisions.

This article includes forward-looking statements and projections regarding Bitcoin, Ethereum, market performance, and the use of hedging strategies such as those involving CME Group’s micro cryptocurrency futures and options. These statements are based on current trends, publicly available information, and speculative assumptions as of June 2025, and they are subject to risks, uncertainties, and changes beyond the author’s control. The author does not guarantee the accuracy, completeness, or timeliness of the information provided, particularly regarding unverified or hypothetical developments.

Cryptocurrency investments, including those in Bitcoin and Ethereum, as well as the use of futures, options, or other derivatives for hedging or trading, carry significant risks, such as volatility, regulatory changes, counterparty risk, and potential loss of principal. The author and publisher are not liable for any losses or damages arising from the use of this content. Opinions expressed are those of the author and do not necessarily reflect the views of any referenced entities or platforms, including Substack or CME Group.